Many People Struggle to Stay Consistent in Managing Their Finances

Most people start using finance apps with good intentions, but

after a few weeks, they stop. Manually entering every expense

feels repetitive, and the process quickly becomes a chore.

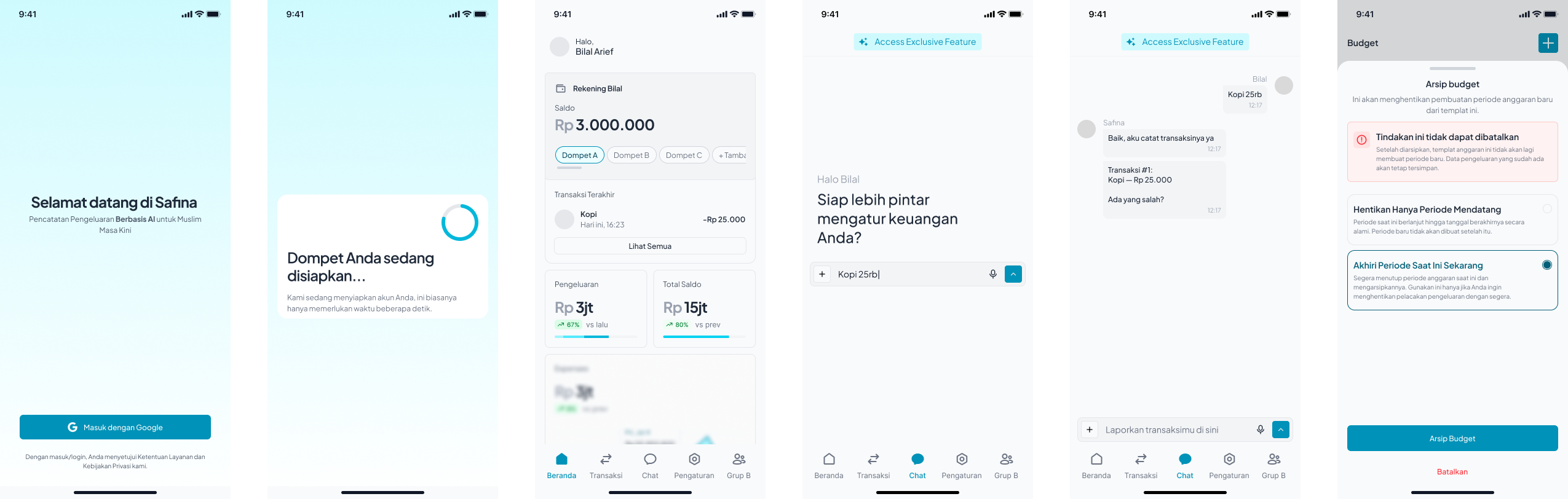

Safina was created to change that habit. This mobile app helps

users track their spending and income through simple

conversations with an AI chatbot. By saying things like

“I spent Rp25.000 on coffee this morning,”

the app automatically records and categorizes the

transaction.

As a UI/UX Designer, my role was to refine the user flow, design

the interface, and ensure that the concept felt simple, natural,

and engaging for everyday use.

Understanding The Problem

Safina’s goal is to make financial management feel effortless. Instead of navigating through multiple forms and buttons, users can communicate directly with the app using everyday language. The challenge was to design this conversational experience while keeping it functional, clear, and enjoyable to use.

Research And Direction

From those insights, I focused on creating an experience that reduces friction, simplifies decision-making, and builds comfort through clarity. This direction guided how I approached the user journey, layout, and visual hierarchy.

Structuring The Experience

Each step was designed to feel continuous, as if the user is in one ongoing conversation rather than switching between different screens. This made the experience smoother and helped maintain a natural rhythm in how users interact with their finances.

Wireframes And Layout Exploration

I experimented with different layouts to make sure the chat interface remained the focal point, with quick access to insights, summaries, and recent transactions. This stage allowed me to confirm the balance between information and simplicity before moving to high-fidelity design.

Visual Design System

Finance can often feel overwhelming, so I aimed to make the

interface look calm and approachable. I used a combination of

soft colors, rounded shapes, and clean typography to build trust

and focus. Spacing and hierarchy were carefully adjusted to make

information easy to scan and understand.

The overall visual direction was designed to give users a sense

of comfort and control, encouraging them to track their finances

regularly.

Final Design Overview

Key highlights include:

👉 Conversational input to record expenses or income naturally

👉 A simple dashboard that visualizes spending patterns

👉 Smart categorization powered by AI

👉 A calm and clean interface that supports consistency

This approach makes finance management easier, transforming a routine task into a friendly daily habit.

Designing For AI Conversation

One of the key parts of this project was defining how the app

communicates with users.

I worked on creating conversation patterns that feel natural but

remain clear and functional.

For example: “Kopi 25rb” → “Transaksi #1: Kopi — Rp 25.000 Ada

yang salah?”

By designing these interactions carefully, the chatbot feels both

capable and friendly, guiding users without confusion.

Future Steps

The next planned features include:

👉 Bill scanning to convert receipts into data automatically

👉 Goal tracking to help users plan savings

👉 AI-driven financial insights to give personalized advice

These ideas aim to make Safina more powerful and proactive in supporting users’ financial goals.

Reflection

My main contributions included:

👉 Refining and structuring the user flow

👉 Designing a conversational interface

👉 Building a consistent and calm visual design system

Through this project, I learned how to connect technology, behavior, and emotion in a way that feels seamless for users.